Marathon Digital (NASDAQ: MARA) rose more than 60% since Monday.

Heck, the S&P 500 is up almost 7% in less than a week!

There’s a lot of bullish momentum hitting markets right now.

If I’m so certain, why don’t I trade this idea?

I get this question from folks who join my millionaire challenge, and it’s a good one.

You see, I can read any chart out there using technical analysis.

However, that doesn’t mean I SEE a trade setup.

This distinction is important because confusing the two can get you into bad trades.

Not to worry.

I’m going to break down the key differences between them so the next time you look at a chart, you know whether you’ve got a trade on your hands or not.

Two Sides of the Same Coin

Techincal analysis is the study of charts to predict future price action.

We look at the change in price and volume over time to forecast what might happen next.

For example, let’s look at a daily chart of MARA.

I drew several important price levels based on where I would expect support or resistance.

Technical analysis tells me:

- The overall trend is down.

- However, bulls recently regained momentum.

- Recent price action pushed shares over the first resistance level on heavy volume.

- Broader markets showed a lot of bullish behavior in the last few weeks.

Taken together, I would expect MARA to push higher over the next few days if not weeks.

So, why wouldn’t I just lay down $10K to buy shares right now?

Let me reframe the question…

If I bought shares right here, where would I set my stop and price target?

I could use the last support level as my stop, but given the huge move the last few days, who’s to say the stock doesn’t swing down there before making its next move higher?

Technical analysis gives me an idea and read on the market. What it doesn’t necessarily tell me is how it will get there.

There are a lot of unknowns with this chart.

The only way to narrow those down is to use a trading pattern.

Why Patterns Work

Chart patterns are a very specific type of technical analysis.

Not only do they forecast WHAT will happen but HOW it’s likely to happen.

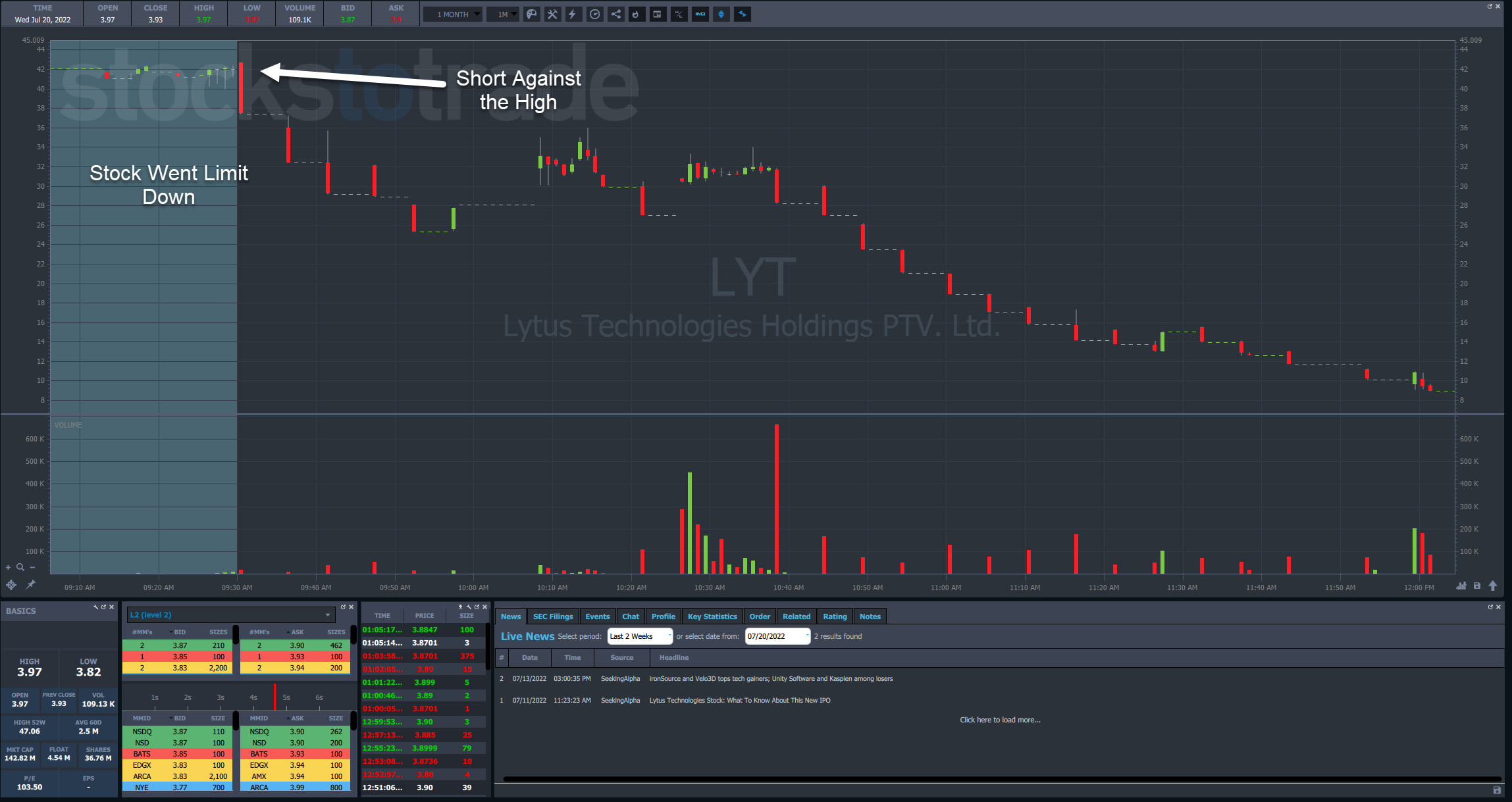

Lytus Technologies Holdings (NASDAQ: LYT) is a great example.

Several of my millionaire students including Tim Lento, Jack Schwartz, Jack Kellogg, and Kyle Williams all banked on a strong short position.

Using the framework I teach in my mentorship program, each of these traders identified LYT as a possible short opportunity.

They all noticed:

- Heavy promoters at work

- Recent IPO

- Huge run in a matter of days

Knowing this, each of them arrived at the same conclusion – shares would likely collapse.

Now, an inexperienced trader might look at the run and try to guess where the stock might top out.

That’s like buying a stock in freefall, it’s a great way to lose your shirt.

Instead, my students use the framework I taught them to enter the trade and manage risk along the way.

They did this using chart pattern setups.

Here’s a hypothetical example using LYT.

Let’s say I see shares start to make a move lower out of the gate.

How do I know that it isn’t just a fakeout?

One clue was the stock went limit down five times in a row.

Through careful study and data collection, I might have discovered that once a stock goes limit down two times in a row after a huge run, it’s likely the start of a collapse.

Using that information, I could enter a short position targeting a move back towards the lows with a stop at the highs.

Some chart patterns are very specific while others, like a bull flag, are a bit more broad.

The broader the pattern, the greater the odds you find a potential setup, but also the lower the odds it works out as intended.

The Bottom Line

Technical analysis and chart patterns go hand in hand.

Learn to incorporate both to maximize your potential.

—Tim

The post Technical Analysis vs. Pattern Setups appeared first on Timothy Sykes.