With less than six months left in 2022…

…traders in a hole have two options.

Option 1: Hold, hope, and pray things get better.

C’mon crashhhhhhhhhh $DIA $SPY $QQQ you can do it, let’s speed this process up please, allllll the promoters & their naive AF followers must be wiped out before & atone for their sins before we can find a lasting base, remember $FUBO $CEI $DATS $ENZC $HMBL $LTNC $SYSX $INND $TGGI

— Timothy Sykes (@timothysykes) June 10, 2022

Option 2: Open your eyes to ALL the day trading opportunities the market’s giving us … and start attacking them.

It all starts with a watchlist. You need to be in the right names if you want any chance of profiting in this volatile market.

Luckily for you, I’ve picked five stocks that I believe are poised to break out this week.

Check them out below…

Top 5 Stocks to Watch This Week

Top Penny Stocks List #1: Artificial Intelligence Technology Solutions Inc. (OTC: AITX)

This thing is a big former runner.

Remember: former runners can run again.

This stock is a perfect example of that.

Go look at a year-long chart of this one. You can see it spiked in August and again in October.

And it’s making moves again, with news!

I’m sure I’ve traded this thing in the past. But I don’t have time to go find an example.

If you ever want to see any of my trades…

I record every trade I make.

It’s part of what makes me a great teacher.

Alright, let’s keep moving!

Top Penny Stocks List #2: The Singing Machine Company Inc. (NASDAQ: MICS)

I know the name isn’t very attractive.

This allows me to make a good point though…

Most of the stocks I trade are garbage.

They spike from hype and then the price falls back down. The growth is unsustainable.

But, traders like myself can profit from that growth.

I need to warn you though. I don’t use buy-and-hold strategies!

This is day trading. Not investing. I want to get in and out quickly with as much cash as possible.

Sound like something you’re into?

Focus on this pattern right now.

So the company’s name is The Singing Machine, and they’re not in the hottest sector.

It doesn’t matter. They’ve got news and a low float.

Stocks with lower floats can spike higher because of a lower supply. That creates a lot of volatility. And I need volatility to profit.

Top Penny Stocks List #3: BIMI International Medical Inc. (NASDAQ: BIMI)

This is a HUGE spiker from October 2021.

It ran 300%+ in one day … try to wrap your head around that.

And it started moving last week with news.

So naturally, I’m laser-focused on this thing.

To prepare for profits add it to your watchlist.

Top Penny Stocks List #4: Redbox Entertainment Inc. (NASDAQ: RDBX)

This is kind of a meme stock that turned into a short squeeze. And it’s been going crazy for months now.

It’s a little out of my price range. But I’m looking for opportunities everywhere.

I’ve traded it before too.

As traders, it’s our job to adapt to current market conditions.

Don’t trade outside of your comfort zone. But always stay open to new ideas and approaches.

Top Penny Stocks List #5: Imperial Petroleum Inc. (NASDAQ: IMPP)

This is a legendary spiker from February and March of 2021.

You’ve gotta take a look at a year-long chart.

The best thing about this stock is it’s in a super hot sector. Energy/Oil and gas.

Energy plays are at the top of my list right now.

Oh, shoot that reminds me. I should add Houston American Energy Corporation (AMEX: HUSA). Well, you can add it now.

Both IMPP and HUSA are great examples of former runners in a hot sector. And they deserve a top spot on my watchlist.

These are the top five stocks to be watching this week.

But it takes more than a watchlist to achieve consistent profits.

If you’re serious about becoming a successful trader, keep reading…

These are the top 5 stocks to be watching this week.

Trading Education

This is where your journey begins. If you can change your mindset from making money to learning, there’s hope.

New to penny stocks? Start with my FREE penny stock guide.

Also, get my best-selling book “An American Hedge Fund” here at no cost.

For the basics of my strategies, read “The Complete Penny Stock Course.”

And if you think you have what it takes, maybe the Trading Challenge is for you. Only apply if you’re willing to study hard. It’s not easy, but it’s where all my top students refined their skills.

**Apply for the Trading Challenge Today**

Trading Challenge students also get access to my daily watchlists. All successful traders make their own watchlists.

If you’re still on the fence about penny stocks…

Why You Should Consider Penny Stocks

You’ve probably heard people say “Penny stocks are scams.” Maybe your financial planner said, “Penny stocks are a very high-risk investment.”

Let me give it to you straight up…

Penny stocks are NOT long-term investments. They’re trading vehicles.

99.9% of penny stock companies fail. Or they do some weird pivot to whatever’s hot (like NFTs) and get a short-term spike. Then they suck again.

That’s what makes penny stocks beautiful. Other people think of penny stocks as investments. In other words, they believe the BS and hype.

Those are your enemies on the trading battlefield. They create massive volatility and THAT is what allows me and my top students to crush it.

The best part is, there’s a 7-step pennystocking framework you can use to identify common patterns.

Then, it’s a matter of discovering…

How to Choose the Right Penny Stocks to Trade

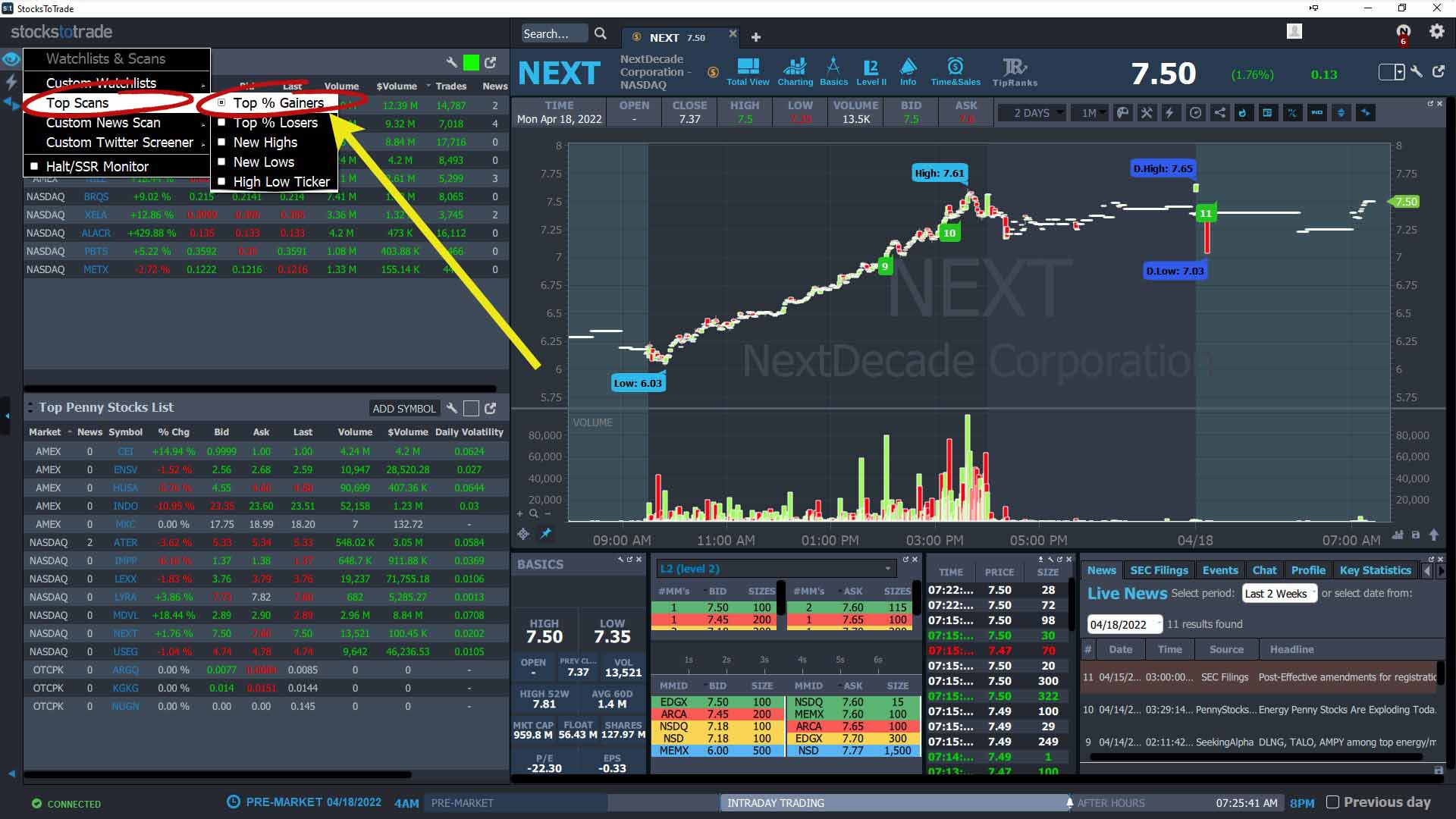

The world of penny stocks opened up when we created a tool that makes it easy. Heck, we even called it StocksToTrade.

That said, people often ask how to choose stocks. It would take you days to sift through a list of all penny stocks. Even a list of the 100 best penny stocks wouldn’t get you very far. You need to drill down.

Here’s where to start…

Look for Big Percent Gainers

This is my number-one criterion and always has been. I’m not interested in boring — especially to grow a small account. If you reach $9.7 million in trading profits like Jack Kellogg, you’ll earn the right to trade boring stocks.

StocksToTrade has several big percent gainer scans built in. Use it.

Look at the Exchange

This is important, especially in the beginning…

OTCs don’t trade premarket or after hours. That’s a good thing for beginners. Also, with OTCs, Level 2 data is more relevant. Once you start trading high-volume listed stocks, it’s more of a challenge to use Level 2.

Finally, some OTCs have a Pink Limited designation. Some even get the dreaded skull-and-crossbones Caveat Emptor label. Be wary of these stocks. I’m not saying to never trade them, just take extra caution. If you’re new, avoid Caveat Emptor stocks altogether.

Investigate the Company History

After a while you probably won’t need to do this. Why? Because you’ll understand why penny stocks are called “Wall Street’s gutter.”

Take off the rose-tinted glasses…

Some penny stock companies change names or sectors as often as we change presidents. At least understand that before you start trading. Where can you find the dirt? Find the ticker on the OTC markets website or SEC Edgar. Then start going through filings.

(Top tip: StocksToTrade has links to all SEC and OTC markets filings. Use it.)

For more on how to read SEC filings, see my DVD guide called “How to Read SEC Filings.”

You’ll get blown away when you start digging. Most of these companies have more skeletons in their closet than a haunted house.

Always Verify Their Claims

The next step is to look for a catalyst. Most big percent gainers move based on news.

This is key…

Don’t take a press release or company tweet at face value. Try to verify the company’s claims.

Again, most of these companies fail. Half the time they have no product and no revenue. Rest assured, they’ll still issue press releases about their “world-changing tech.” Or some big contract. Or a new gold mine, oil well, or metaverse property.

Most of it is absolute BS. Which is why you should NEVER believe the hype.

Instead…

Be Skeptical

That applies no matter what promoters tweet or what you heard in a Discord chat. THOSE are the biggest scams in this industry.

That’s why it’s so important to use StocksToTrade and get the Breaking News Chat add-on.

The Breaking News Chat guys are on top of promotions, chat pumps, and sketchy press releases. They alert it all in chat. That saves you hours of research sifting through so-called due diligence.

I would NEVER trade without StocksToTrade Breaking News. Get it today.

Rinse and Repeat to Add Penny Stocks to Your List

It’s as simple as that. Add more stocks to your watchlist by repeating the process. I keep roughly 20–30 stocks on my big watchlist.

Each day cull your list. Take one or two off or add them to a secondary list. Then add the day’s top percent gainers with a catalyst and volume.

Frequently Asked Questions About Penny Stock Lists

Studying my watchlist is a good start, but you need to learn…

How to Create Your Own Penny Stocks List

Whether you call it a penny stocks list or a watchlist, the process is the same. It’s not difficult but you might find it time consuming in the beginning. Go through the process described below. Like everything else in life, with practice and experience it will get easier.

How Can You Create Your Own Watchlist?

Start by looking for big percent gainers. For two decades, big percent gains have been my #1 criteria. After that, look at trading volume. Focus on high-volume stocks. Finally, try to find the catalyst or reason behind the price action.

Should I Create a Watchlist Every Day?

All serious traders create a daily watchlist. If you’re serious about trading penny stocks, a daily watchlist is essential. No excuses.

Does Tim Sykes Provide a NO-COST Watchlist?

Yes. Subscribe to my weekly penny stock watchlists below.

For more information and a detailed guide on how to create a watchlist, read “Stock Watchlist Guide: Tips & Examples to Develop Your Own.”

How to Use the Top Penny Stocks List Weekly Update

When you read the weekly penny stock list (and the monthly watchlist), don’t think of them as hot picks. Frankly, sometimes they’ll be duds. That’s why it’s called a watchlist. Welcome to penny stocks.

👉🏼 SUBSCRIBE to my NO-COST weekly stock watchlist here.

It all starts with looking for big percent gainers. Try to figure out why I’ve put the stocks on my list. Study so you can help yourself become a self-sufficient trader. Only fools chase hot picks.

Conclusion

Bookmark this post and keep coming back. Every Monday (unless the market’s closed), I update this with my top penny stocks to watch for the week.

Start making your top penny stocks list today. It’s like exercise — at first it’s a little uncomfortable. But the more you do it, the easier it becomes. Review the steps to create your own watchlist above

What do you think about this penny stocks list? Comment below, I love to hear from all my readers!

The post Top 5 Stocks To Watch This Week: June 13, 2022 appeared first on Timothy Sykes.