Traders should NEVER gamble with questionable setups.

I teach my students to only enter trades they can lay out on paper.

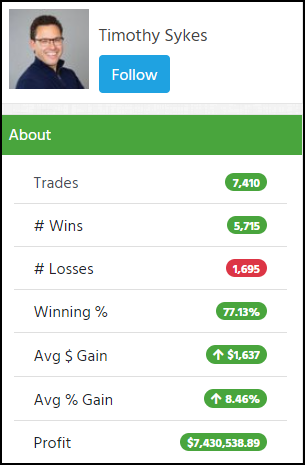

Because I focus on locking in profits and cutting failed setups quickly, I’ve created a healthy win percentage of 77.13%.

All my trades are open to the public on profitly

Year-to-date, I’ve made $104,804.34 in total profits. However, $21,548.37 came in the last 3.5 weeks.

There’s one market area that’s on fire!

Let me show you how to locate these hot stocks and create profitable trade setups.

Hot Stocks

Right now, high percentage gainers offer better opportunities than other stocks.

And this goes beyond the typical over-the-counter (OTC) stocks I trade.

I’m seeing massive runs in stocks with high short interest like Toughbuilt Industries Inc. (NASDAQ: TBLT), hot sector stocks like Vertical Aerospace Ltd (NYSE: EVTL), and more.

But, I don’t just go after any old premarket mover.

I want stocks with:

- News catalysts

- Heavy promoter pumps

- Lots of volume

To locate these stocks, I rely on our Breaking News chat room on the StocksToTrade platform.

You’ve probably heard me talk about this before, but I can’t stress enough how valuable it is for traders.

Our analysts sift through reams of data to find the stories that matter on the stocks with big moves.

If I want to know why a stock is up 100%, I turn to them.

Plus, they also keep tabs on promoters and pumps, which is hugely important for my trading.

Now, sometimes I’ll spy news on a stock that has yet to move in premarket.

That’s exactly what happened with my E-Cite Motors (OTC: VAPR) trade.

Those are the opportunities that get me excited because I can smell the run before it happens.

Another way to suss out these plays in the premarket is with a screener.

The one I use in the StocksToTrade platform lets me filter for stocks with the highest percentage gains in the premarket as well as narrow them down by float and volume.

Trial the StocksToTrade Platform today.

Create Your Setup

While I teach my students the fundamentals of trading, each has developed their own strategy.

There’s no one way to trade stocks with big gains.

However, there are some core principles that anyone needs to apply, top among them is risk management.

Right now, I’m looking for these big gainers to push hard so the pullbacks may be shallow if they occur at all.

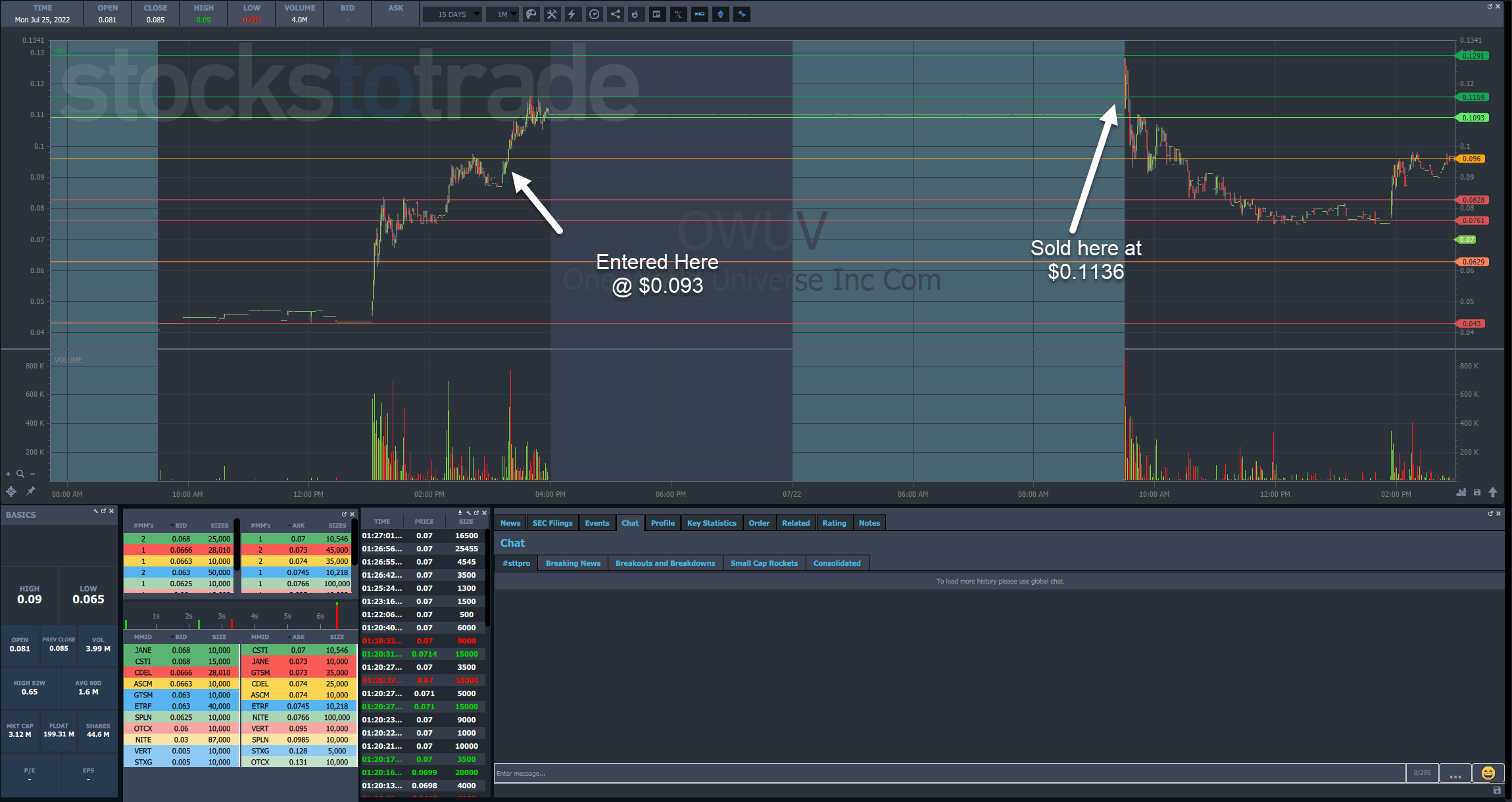

One World Universe Inc. (OTC: OWUV) is a good example of a stock that ran hard when news hit on July 21.

Shares pressed into the close on heavy volume.

Since this was the first day run for the stock, I expected we’d see a pop on day two.

Sure enough, I was able to buy into a slight late-day pullback and sell into a rip at the open the following day.

I entered this swing position near the close on Thursday.

What if the stock dropped overnight?

That was a risk. However, I also watched how shares finished the day.

From the pullback, OWUV climbed into the close, setting a new high of the day.

Had shares not run farther or pulled back, I would likely have cut the trade.

With any trade I take, there are expectations about what I want to see from the price action.

If the stock doesn’t meet my expectations, I cut it loose.

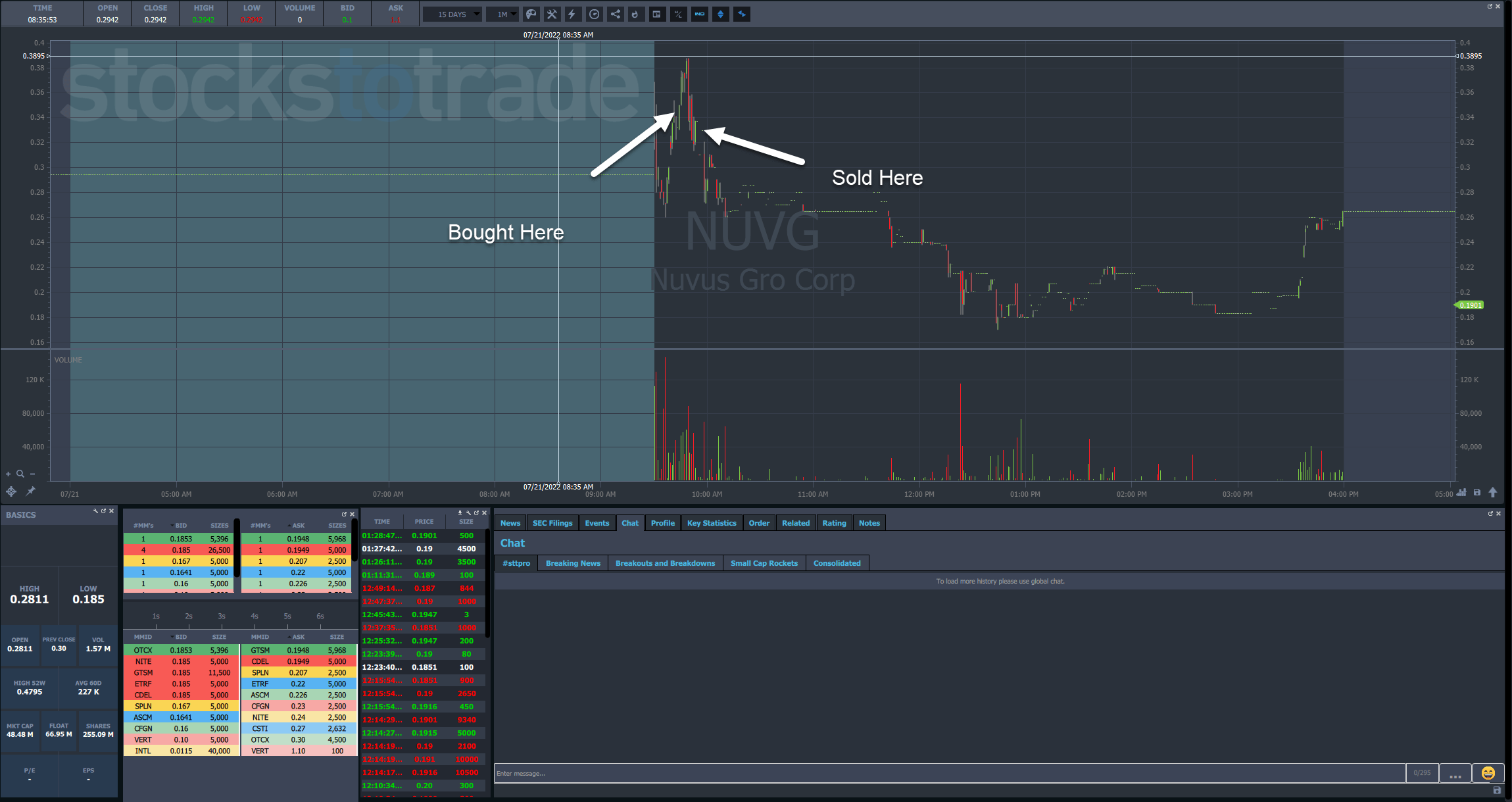

That’s exactly what happened with NuvusGro Corp. (OTC: NUVG).

I expected shares to continue to climb from my entry. Instead, they popped and then quickly came back down.

I saw no point in holding on when the price action told me not to.

What’s Changed

In the first half of 2022, we didn’t see many multi-day runners.

Even the single-day spikers quickly faded.

Now, I’m witnessing a shift, at least temporarily.

More stocks are pushing for 2-3 days, especially when the news is good and you have a weekend to digest it.

That’s not to say that all stocks qualify for this bullishness.

You have to watch to see how they trade throughout the day, especially right after the news catalyst.

If the stock is failing to break new highs and remains rangebound, it’s unlikely to see another run the following day.

However, there are plenty of previous runners seeing a resurgence such as Redbox Entertainment Inc. (NASDAQ: RDBX) and more.

Keep a healthy watchlist of stocks with big runs and see which ones set up for day two or three movers.

–-Tim

The post Pay Attention to These Stocks appeared first on Timothy Sykes.